Gambling Losses Tax Write Off

Nov 30, 2020 While you can deduct gambling losses, these deductions cannot exceed the amount of your total winnings. For example, if you win $1,000 playing the lotto, but you’ve purchased $2,000 worth of losing tickets, you can write off the losing tickets only up to the amount of your $1,000 winnings, and not the entire $2,000 you lost playing. Jun 04, 2019 How do i deduct gambling losses on a California return? Complete the itemized deductions section on your federal return. That will carry over to your CA return, if you itemize on that return, even if you used the standard deduction on the federal return.

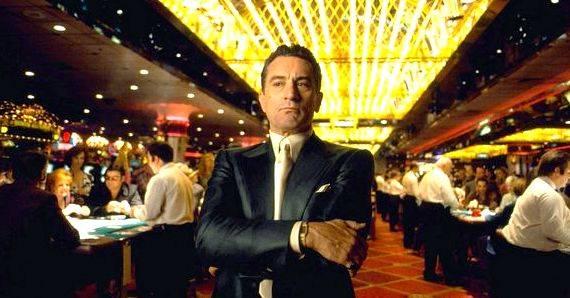

© Photo: Sasha Cornish / EyeEm (Getty Images)The IRS views winnings from gambling as taxable income, but did you know that you’re allowed to deduct gambling losses, too? While losing money at a casino or the racetrack does not by itself relieve your tax burden, it can reduce taxes owed for your other winnings, ultimately saving you money.

Gambling Losses Tax Write Off Rules

How to know if you can deduct your gambling losses

Gambling loss deductions save you money by reducing your taxable income. But there’s a trick to this—you can’t claim gambling losses that exceed your winnings, as losses are inextricably linked to your winnings for tax purposes. If you have no winnings to claim, you can’t deduct your losses.

As an example, let’s say that in a given year you went gambling twice, winning $6,000 in one instance, but losing $8,000 in another. In this case, you can only deduct $6,000 from that $8,000 loss. The remaining $2,000 in losses can’t be carried forward or written off. Conversely, if you won more than you lost, you’d owe taxes on the difference between your winnings and losses as “other income”—but at least those taxes would be reduced.

(If you’re a full-time, professional gambler the requirements are different: you will report your earnings like they have resulted from a business, as self-employed income).

Video: How to improve your credit score without a credit card (USA TODAY)

How to claim gambling losses

Deductible gambling losses can result from online casinos, poker games, sports betting, lotteries, prize draws, horse and dog racing, and even your office fantasy sports pool. To report any of these gambling losses, you’ll be required to itemize your deductions. This makes sense if the total of all your itemized deductions exceeds the standard deduction ($12,400 for taxpayers who are single or are filing separately from their spouse). If you claim the standard deduction, you don’t get the opportunity to reduce taxes for winnings owed by deducting gambling losses.

Keep in mind that you must be able to substantiate any losses you’re claiming, which means you’ll need to keep records of your gambling.

Track your winnings and losses

You can’t just say “I lost a bunch of money gambling” to the IRS. They require you to provide records of your winnings and losses to back your claim. Therefore, you should keep track of:

- the date and time of your gambling session

- the type of gambling

- the name and location of the gambling venue

- the people you gambled with

- how much you bet, won and lost

You should also keep credit cards statements, payout slips, receipts, tickets, bank withdrawal records, and statements of actual winnings. Other documentation can include:

- Form W-2G (typically given or mailed to you by casinos after a big payout)

- Form 5754 (a form for when you’re part of a group that earns money through gambling; you might see one of these if you and your co-workers are cashing in a winning lottery ticket)

Do you or someone you know need help with a gambling problem? Call the National Problem Gambling Helpline Network (1-800-522-4700).

Since the MGM casino opened in August, gamblers have reportedly wagered more than $428 million on MGM Springfield’s slot machines that generated about $40 million in revenue for MGM and reportedly another $18.5 million in revenue from table games. This is in addition to the $2 billion or so per year wagered at the Plainridge Park Casino that generates $170 million in revenue. All of this revenue came out of the pockets of those eager to try their luck.

In Massachusetts, gross income is defined as federal gross income as defined in the Internal Revenue Code as of January 1, 2005 with certain modifications. Federal gross income is all income from whatever source derived unless specifically excluded. Federal gross income includes winnings from all types of gambling, including lottery, slot parlor and casino. However, federal law allows taxpayers to deduct their losses to the extent of any gambling winnings as an itemized deduction.

For example, if a taxpayer won $5,000 in a casino for federal tax purposes they could deduct losses up to the full amount of winnings. For taxpayers who gamble frequently, it would not be unusual for losses to equal or exceed winnings. So for federal purposes after the deduction for losses, it was possible that very little income was reported on the federal tax return. The burden is on the taxpayer to prove any losses (see Rev proc 77-29, 1977-2 CB 538).

However, if the taxpayer was a Massachusetts resident, the full $5,000 would be included in Massachusetts income with no offsetting deduction. So if the taxpayer won $5,000 on a lucky visit to the casino but let it ride and actually lost all $5,000 of it, for federal tax purposes that taxpayer would have net federal income of zero. However, if the taxpayer lived in Massachusetts, the full $5,000 would be included in state income with no offsetting deduction so the taxpayer would pay state income tax on the full $5,000.

Fortunately, the law that expanded gaming in Massachusetts contained provisions that allow taxpayers to deduct casino losses to the extent of gambling winnings. However, the law only applies to losses incurred at a gaming establishment licensed in Massachusetts.

Therefore, in the example above, if the Massachusetts taxpayer won $5,000 at the tables at MGM in Springfield, Massachusetts, and then took a trip to Connecticut and lost the $5,000 at the Mohegan or Foxwood casino, no deduction would be allowed when computing Massachusetts income tax.

List Tax Write Off

Categorized:Gambling, Taxes

Tagged In:casino, gambling losses, Income Tax, tax deduction